CCTV News: The "Private Economy Promotion Law" will be officially implemented on May 20. This is the first basic law on the development of the private economy in my country, and it clarifies the legal status of the private economy for the first time. On the morning of May 8, the State Council Information Office held a press conference on the relevant situation of the Private Economy Promotion Law. At the press conference, a relevant person in charge of the State Administration for Financial Regulation introduced that in response to the needs of private enterprises in terms of disaster avoidance, employment, and technology research and development, the State Administration for Financial Regulation developed special insurance products and optimized services.

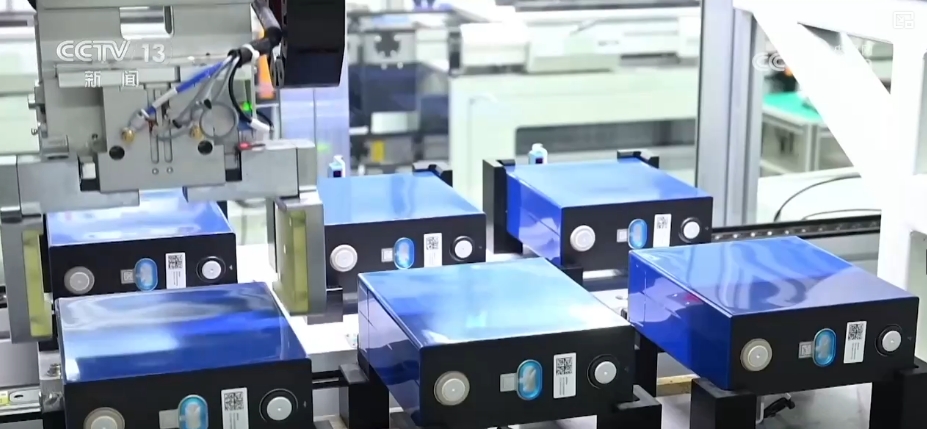

Cong Lin, deputy director of the State Administration for Financial Supervision and Administration, introduced that in the field of high technology, pilot projects such as dispersed technology research and development mechanisms, network security insurance, and drone insurance are carried out. For new citizens and flexible employment groups with relatively concentrated employment in private enterprises, focus on their specific occupational risks and use inclusive insurance products to enhance their protection efforts. Private enterprises account for the majority in the new energy vehicle industry, guiding the insurance industry to launch exclusive insurance terms and rates, and build a "good insurance insurance insurance" platform to realize "willing to cover all insurances and all investments must be covered."

Offline, the State Administration for Financial Regulation and the National Development and Reform Commission have established a coordination mechanism for supporting financing for small and micro enterprises, and promoted credit funds to "directly reach the grassroots level, fast and convenient, and appropriate interest rates". Through this mechanism, 12.6 trillion yuan of new loans to small and micro entities have been issued to small and micro entities, with an average interest rate of 3.66%.

Jungle introduction, online, promote the construction of credit information sharing and financial comprehensive service platforms in many places, "let data run more, enterprises and banks run less", and use data information to support banks to issue credit loans. As of the end of the first quarter, the balance of credit loans for private enterprises was 18.1 trillion yuan, an increase of 15.4% year-on-year.

At the same time, the State Administration for Financial Regulation, in conjunction with the financial department, promoted the establishment of a government-based financing guarantee system covering the country, and regarded serving small and micro enterprises as the main policy benefit indicator. The guarantee rate of this type of business shall not exceed 1%, which is far lower than the commercial guarantee level. As of the end of the first quarter, government-based financing guarantee institutions provided financing direct guarantee balance of 1.88 trillion yuan for small and micro enterprises, an increase of 11.5% year-on-year.