CCTV News: Prepaid consumption refers to the card recharge model commonly used by merchants such as gyms and beauty salons. In recent years, incidents such as merchants running away after applying for a card, being prone to recharge and being difficult to refund money, which seriously damages consumer rights. On the 14th, the Supreme People's Court issued the "Interpretation on Several Issues Concerning the Application of Laws in the Trial of Civil Disputes in Prepaid Consumers", solving the problems of the public's concentrated response to the public in the field of prepaid consumer, such as running away from the payment, overbearing clauses, and non-refunding of payments, and better protecting consumer rights.

The unfair terms such as "no refund for payments" and "restricted card transfers" are invalid

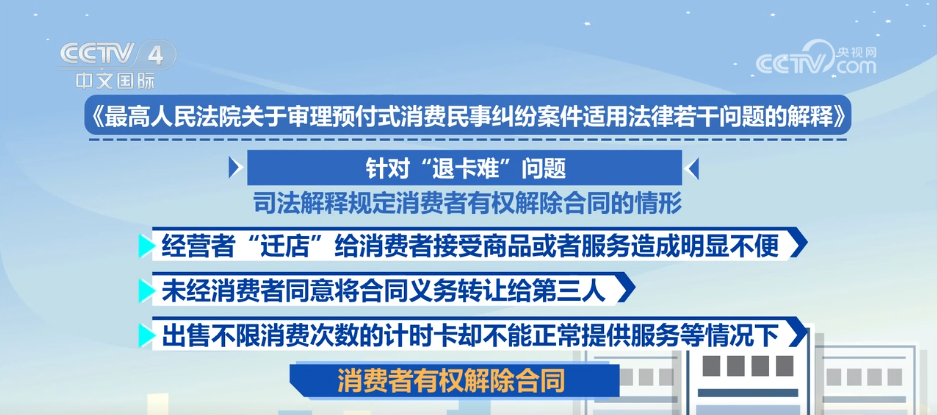

The judicial interpretation stipulates that "unfair terms" such as non-fair terms such as non-fair receipts, non-refundable cards, and restricted card transfers should be determined to be invalid in accordance with the law. In addition, in response to the problem of "difficulty in returning cards", the judicial interpretation stipulates that consumers have the right to terminate the contract. If the operator "relocates the store" causes obvious inconvenience to consumers for receiving goods or services, transfers the contractual obligations to a third party without the consumer's consent, and sells time cards that are not limited to the number of times of consumption but cannot provide services normally, the consumer has the right to terminate the contract.

Solve the "difficulty in holding accountable" and clarify the responsible parties and mall obligations

In prepaid consumption, merchants' routines of "changing vests" and "losing out of the shell" are common. In actual operation, Company A is, but Company B receives the payment when applying for a card. The boss shirking responsibility for each other when he runs away, causing consumers to fall into the dilemma of protecting their rights. The judicial interpretation clarifies the responsible parties under the common prepaid consumption transaction model. Regulations: If an operator allows others to use their business license, or otherwise allows others to enter into a prepaid consumption contract with consumers in their name, the consumer has the right to hold them accountable in accordance with the law.

The merchant "runs away" and the mall fails to fulfill its review obligations.

The mall, as a venue lessor, has the obligation to review the tenant's qualifications. For example, the mall should check whether the merchant has a legal business license and whether it provides relevant business qualification certificates. If the mall fails to fulfill its review obligations and the merchant runs away, consumers can hold the liability of the shopping mall site renters at fault. This regulation is to prevent unqualified operators from "running away" to evade debt after using the shopping mall site to collect payments.

Regulate "professional store closures" in accordance with the law to protect the legitimate rights and interests of consumers

The "Implementation Measures for Company Registration Management" which will be implemented on February 10 stipulates that enterprises that maliciously change legal representatives and transfer assets to evade debts may revoke their registration or filing, and impose restrictions on the relevant responsible persons to enter the market within 3 years. This regulation can be said to be a precise blow to "professional closed shop people". In addition, Beijing, Gansu and other places have established prepaid consumption supervision service platforms, integrating the responsibilities of multiple departments, realizing full-chain supervision such as card issuance and filing, capital flow, etc., and better protect consumer rights.