CCTV News: Recently, many foreign institutions such as UBS Securities and Lubomai Fund have released research reports, believing that China's innovations and breakthroughs in fields such as artificial intelligence are constantly increasing the attractiveness of Chinese assets.

The latest special research report released by UBS Securities shows that the computer industry index ranked first in the A-share industry from February 5 to 13 after the holiday, with an increase of 18%.

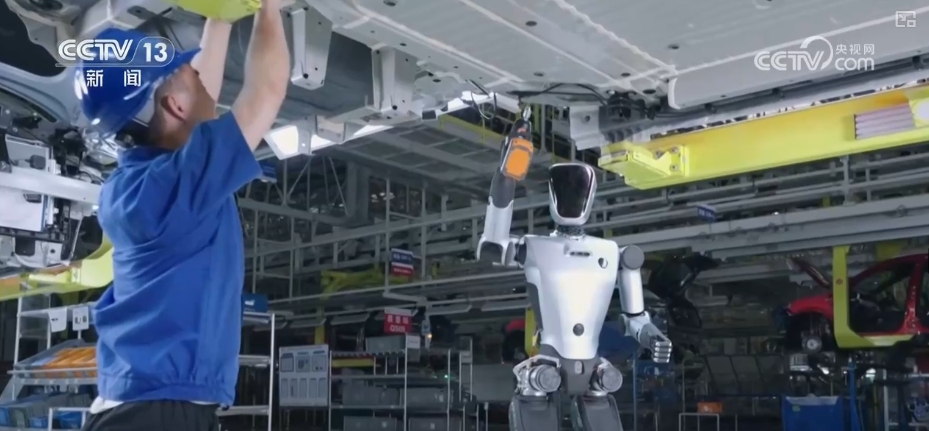

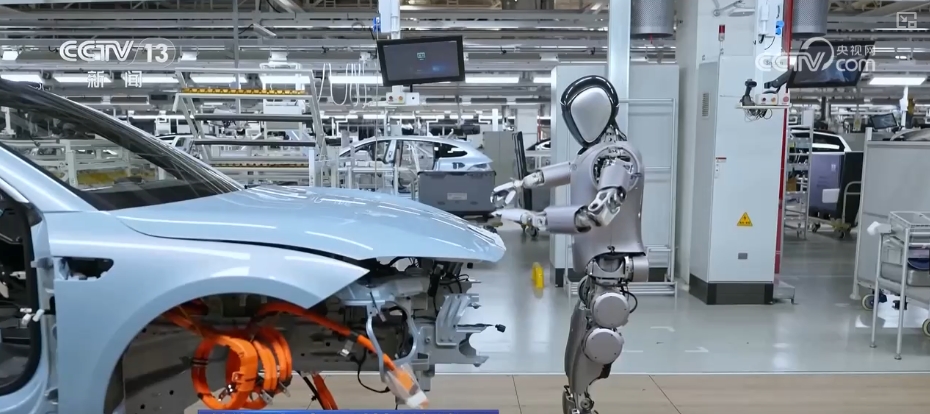

At the same time, the market value of stocks in the technology concept sector in A-shares has now reached 21%, a significant increase from 15% in 2022. Analyst Meng Lei said that China's recent technological innovation in the field of artificial intelligence will have a continuous impact on many industries with long industrial chains including semiconductors, software, medical care, and automobiles.

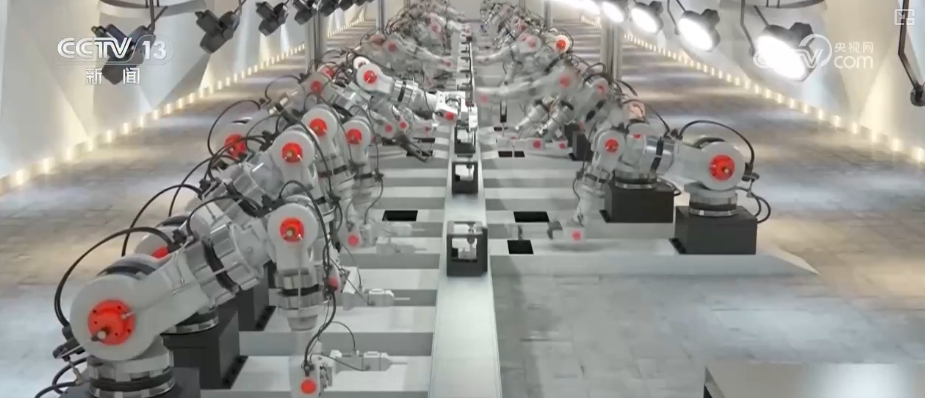

Meng Lei said that the reduction in generative AI costs is expected to continue to benefit more industries, and more Internet data centers will also help AI model training, and AI-driven drug research and development will be more widely used. The smart car industry will be more competitive, and will continue to improve the comfort of life, meet consumer needs, and will continue to show the value of related assets.

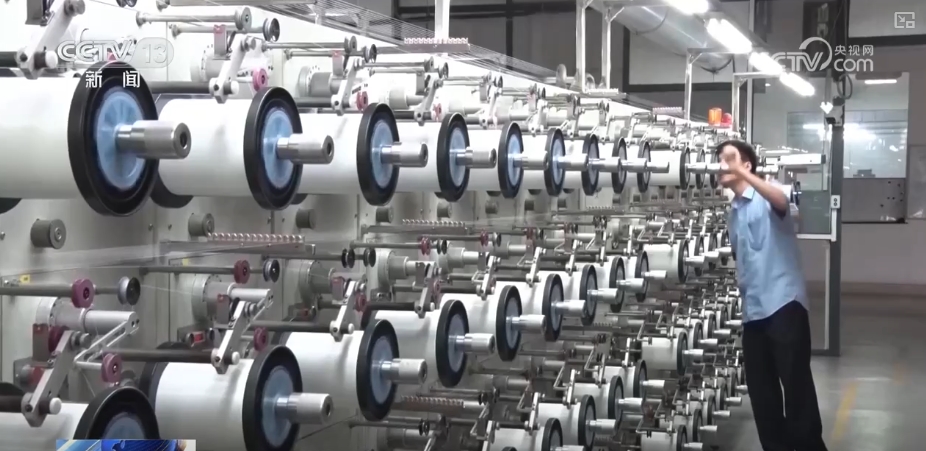

The research report of Lubomai Fund believes that it is optimistic about China's long-term innovation capabilities, and more scientific and technological innovation achievements will bring more investment opportunities in more fields such as green transformation and manufacturing transformation.

Zhu Bingqian, chief strategist at Lubomai Fund Management (China) Co., Ltd., said that China is one of the most important industrial innovation bases in the world. In the long run, high-end manufacturing and green energy transformation are now attracting the attention of international investors.

The continuous breakthroughs in China's technology have made more institutions believe that global investors will continue to increase their investment in China. Morgan Stanley's research report predicts that global investors' attention to Chinese assets will continue in the future. Goldman Sachs' research report predicts that China's good economic growth prospects combined with potential confidence are expected to bring in more than US$200 billion in portfolio capital inflows. Foreign capital is actively investigating the Chinese market and increasing its layout

In the research reports released by foreign institutions, we can see that they continue to be optimistic about China's scientific and technological innovation. Not only that, foreign institutions are also constantly exploring high-quality Chinese assets and actively making arrangements.

In the Shanghai Office of Morgan Asset Management, there are dozens of discussion meetings covering various industries in China every day from 8:30 am to the second half of the night. Du Meng, who has worked here for 18 years, said that he clearly felt that every time he had a meeting with overseas, he interacted and asked questions very enthusiastically.

Du Meng, deputy general manager and investment director of Morgan Asset Management (China), said that the attractiveness of Chinese assets is increasing. Overseas colleagues may have communicated with them every quarter, but now they may have fallen to every month, or even weekly. During the communication, they learned that investors in the Middle East, Europe and the United States and other emerging markets are now increasing their interest in the Chinese market.

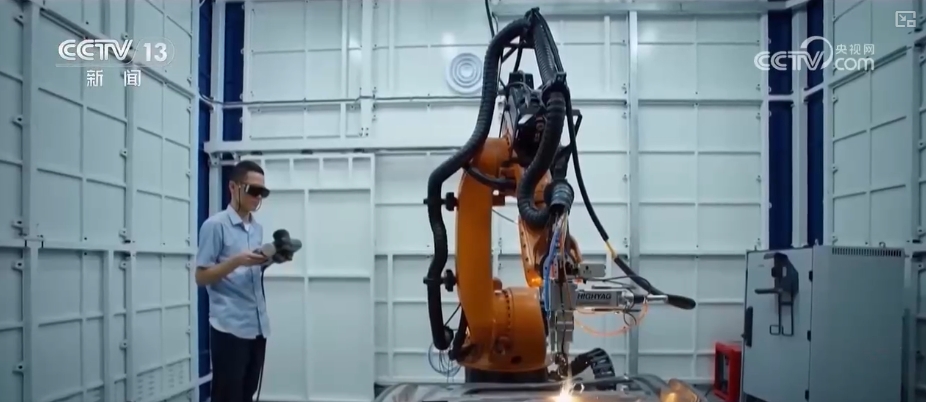

Increasing field research is also the focus of work of foreign institutions recently. Early in the morning, Morgan Asset Management analyst Xu Fan was going to investigate a robot company. In recent times, he has been visiting and investigating companies around the new quality productivity.

Xu Fan said that they are now looking for some companies related to China's high-end manufacturing and new quality productivity fields, want to see the relevant technologies, including its industrial chain and supply chain maturity.

In the R&D center of this robot company, a new mowing robot being tested brightened Xu Fan's eyes. Orders, production capacity, supply chain, talents and R&D capabilities are all key points that these foreign investment research focus on.

Xu Fan said that the design of the algorithm, including the response to the industrial chain, was finally shipped overseas for sale, and the entire industrial chain felt very smooth. The entire industrial chain is their focus on research direction and will continue to be closely followed in the future.

The company's head said that in recent times, the number of institutions that have come to the survey has increased a lot compared to before.

The reporter's statistics found that foreign institutions such as Abu Dhabi Investment Bureau, HSBC, Schroeder, Deutsche Bank, and BNP Paribas have appeared on the research list of A-share listed companies many times since 2025. The survey scope covers many industries such as chips, electric vehicles, consumption, and home appliances. Many foreign institutions said that China is expected to make more breakthroughs in the fields of new quality productivity and high-tech manufacturing in 2025.